irs federal income tax brackets 2022

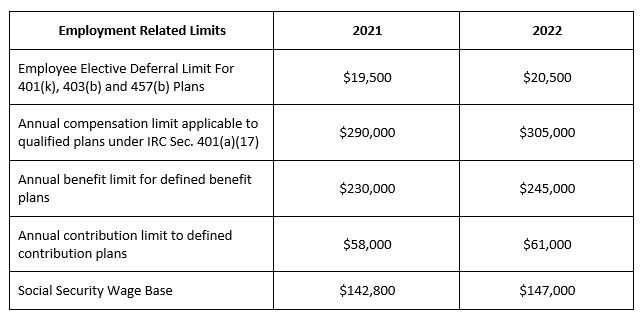

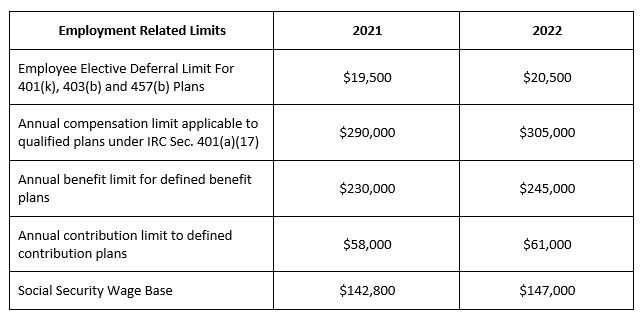

The refundable portion of the Child Tax Credit has increased to 1500. The rate of social security tax on taxable wages including qualified sick leave wages and qualified family leave wages paid in 2022 for leave taken after March 31 2021 and before October 1.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

The capital gains tax rates will remain the same in 2022 but the brackets will change.

. 2022 Tax Brackets. 23 February 2022 - See the changes. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

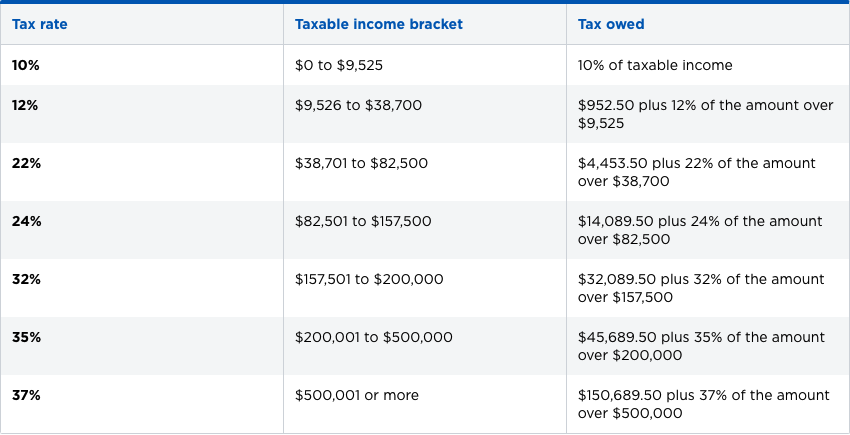

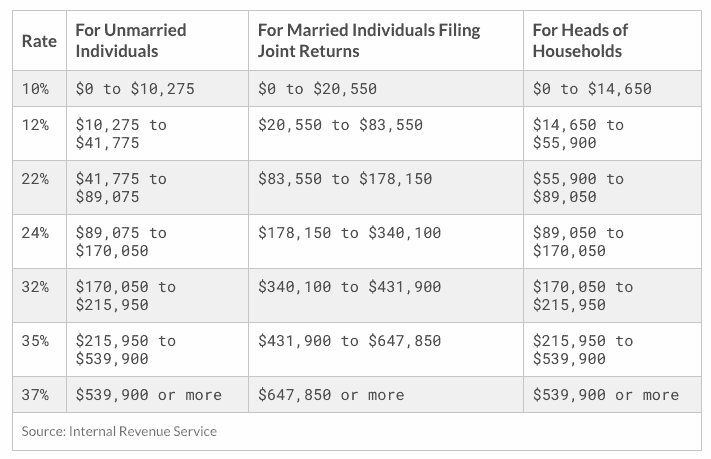

The top rate of 37 applies to income. The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts. The federal income tax rates for 2022 did not change from 2021.

35 for incomes over 215950 431900 for. 51 Agricultural Employers Tax Guide. Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL.

Using 2022 tax brackets heres how theyll be taxed. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Ad Compare Your 2022 Tax Bracket vs.

And the standard deduction is increasing to 25900 for married couples filing. The next 31500 of income falls. The IRS did not change the federal tax brackets for 2022 from what they were in 2021.

Nov 11 2021 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid. Income Tax Brackets Marginal tax rates for 2022 havent changed but the level of taxable income that applies to each rate has gone up. The standard deduction for married couples filing jointly for tax year.

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. It is taxed at 10 which means the first 9950 of the. This means that these brackets applied to all income.

10 12 22 24 32 35 and a top bracket of 37. 8 rows 2022 Federal Income Tax Brackets and Rates. Ad File For Free With TurboTax Free Edition.

See If You Qualify and File Today. 2022 tax season kicks off Monday as IRS begins accepting returns 0535. The current tax rates for the seven brackets are 10 12 22 24 32 35 and 37.

Discover Helpful Information And Resources On Taxes From AARP. 7 rows Federal income tax rate table for the 2022 - 2023 filing season has seven income tax. 10 12 22 24 32 35 and.

0 percent for income up to 41675. The same goes for the next 30000 12. Your 2021 Tax Bracket To See Whats Been Adjusted.

It provides supplemental federal income tax information for corporations. The first 10275 of income falls into the 10 tax bracket resulting in a tax of 102750. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS.

This publication supplements Pub. 15 percent for income between 41675 and. Irs depreciation tables 2022.

The IRS has set seven tax brackets 2022 taxpayers will fall into. It describes how to figure withholding using the Wage. Your Federal Income Tax - IRS tax forms.

Jan 10 2022 Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G. Ad Personal Business Tax Return Free Consult 30Yr Exp NJNYFL. There are seven federal tax brackets for the 2021 tax year.

There are still seven in total. The table of contents inside the front cover the introduction to each part. The lowest tax bracket or the lowest income level is 0 to 9950.

The Kiddie Tax thresholds are increased to 1150 and 2300. 7 rows Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket. 15 Employers Tax Guide and Pub.

In 2022 the income limits for all tax. 10 12 22 24 32 35 and 37 depending on the tax bracket. There are seven tax brackets the IRS adjusts each year for inflation.

This publication discusses the general tax laws that apply to ordinary domestic corporations.

2022 Tax Inflation Adjustments Released By Irs

Federal Income Tax Brackets Brilliant Tax

Federal Income Tax Brackets Brilliant Tax

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

New 2021 Irs Income Tax Brackets And Phaseouts

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More